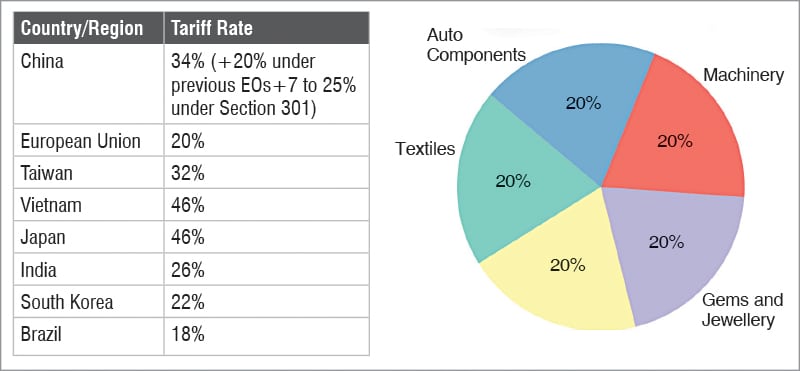

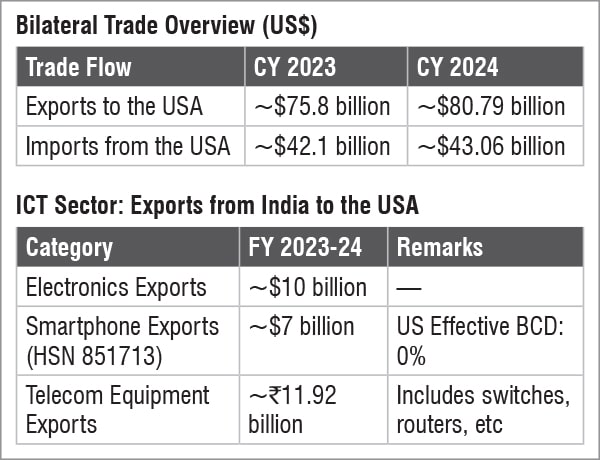

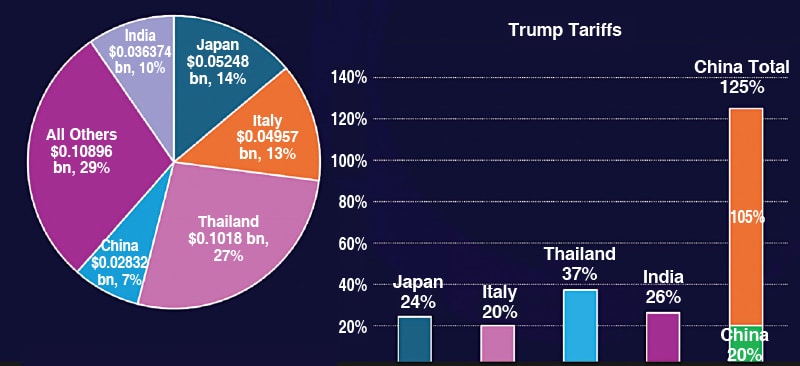

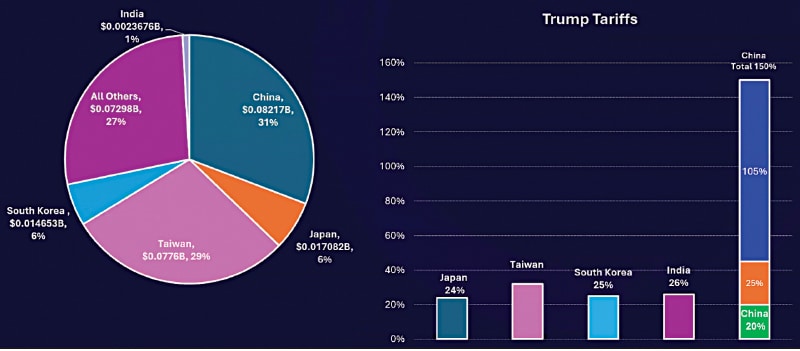

The US Executive Order on reciprocal tariffs imposes a 26% duty on Indian exports—electronics, smartphones, telecom gear, and machinery. While challenging for exporters, the move favours India as regional competitors face steeper rates. The order is set to reshape supply chains, redirect investments, and influence trade talks. This piece examines its impact on India’s ICT sector and the strategic decisions ahead.

Global trade has resembled a high-stakes game with shifting rules since the advent of US tariffs—commonly known as the ‘Trump Tariffs.’ Originally introduced under Section 301 of the Trade Act of 1974 to counter unfair trade practices, particularly by China, these measures have since expanded into a tangled web of duties far beyond their initial intent. Today, countries from Vietnam to Myanmar, and even the European Union, must navigate this volatile terrain, facing varying tariff rates based on trade surpluses and economic behaviour.

For the electronics industry—the backbone of modern technology—these changes have not merely raised the cost of doing business; they have reconfigured global supply chains. Companies are being forced to reassess sourcing, production, and market strategies in real time, from semiconductors to smartphones. And it is not just about paying more at customs. As the US sharpens its strategy, deploying reciprocal tariffs based on trade imbalances, import-export dependencies, and even component origin tracing, the industry faces a sobering truth: Adaptability is not optional—it is survival.

Those anticipating the next move will thrive in this new era of global commerce. Those who delay will struggle to catch up.

For businesses, the message is clear:

- Stay informed.

- Understand the legal framework.

- Reengineer your supply chain before you’re forced to.

How tariffs are reshaping the electronics industry

Imagine being an electronics manufacturer. Your latest product is sleek, smart, and built from components sourced globally. But here is the problem: Before it even reaches the shelf, its price is already under pressure. From semiconductors to fully assembled devices, imported parts are caught in an expanding web of tariffs. A single misstep in labelling a component can cost significantly. For instance, a chip assumed to be for a communication device? Customs might categorise it as an automotive part. Suddenly, a 25% tariff is imposed.

The stakes rise further if your supply chain includes China or Hong Kong. An additional 10% duty has already become 20% in many cases, under the International Emergency Economic Powers Act (IEEPA)—officially justified as protecting national security, but leaving importers to absorb the added cost. US export manufacturers are especially affected; the 20% duty paid at entry remains even if a product is re-exported. No rebates. No exemptions. Just an embedded cost reshaping margins and pricing strategies.

Adapt or pay up

In today’s environment, businesses are learning fast; adapting strategies is no longer optional. Avoiding profit erosion is essential. Every component must be classified with surgical precision to ensure both efficiency and compliance. Tariffs can no longer be treated as temporary disruptions; they are a permanent element of cost structures, requiring thoughtful planning and integration into long-term models. The global electronics manufacturing game is not only about innovation but also navigation.

| What smart companies are doing now |

| • Mapping their supply chain. Every part is traced, documented, and its country of origin logged. • Building alternate sourcing. Manufacturers are rethinking dependencies on Chinese components. • Legal pre-checks. Consulting trade law experts before shipments hit US ports, not after. |

E-commerce in the crossfire: Enter the E-port tax

The most disruptive development arrived with the elimination of the de minimis exemption for low-cost Chinese imports. Starting May 2, even a $1 item from China incurs full duties. By June 1, any item under $800 attracts a minimum tariff of $200. These policies, aimed at e-commerce, are forcing small businesses and consumers to reconsider sourcing strategies.

Countries such as Vietnam and Myanmar face heightened tariffs—up to 44%—as part of a US attempt to rebalance trade flows. One rule offers limited relief: Tariffs are reduced if at least 20% of an exported product’s value originates from US-made components. However, if the US content falls below this threshold, full tariffs apply. Proving that share has become a complex legal exercise.

Vietnam and Myanmar have been subject to severe tariffs under a system that may appear arbitrary but is structured to pressure trading partners into adopting what the US defines as ‘fairer’ trade practices. This creates a grey area for companies dealing with multi-sourced products like electronics, as there is no universal rulebook for determining a product’s country of origin.

Often, it is the courts, not customs, that make the final determination. A single misclassified shipment can wipe out an entire profit margin. The US tariff model considers several economic factors: bilateral trade deficits, import volumes from specific countries, and the sensitivity of prices and demand to tariff changes. Once calculated, the tariff rate is typically halved to create a reciprocal discounted rate designed to reduce market disruption. Yet, this often introduces further complexity for businesses attempting to forecast costs.

For countries like India, where trade balances fluctuate, tariff rates shift accordingly, impacting the cost structure of everything from raw materials to finished products.

The complex puzzle of ‘country of origin’

Oops! This is an EFY++ article, which means it's our Premium Content. You need to be a Registered User of our website to read its complete content.

Good News: You can register to our website for FREE! CLICK HERE to register now.

Already a registered member? If YES, then simply login to you account below. (TIP: Use 'forgot password' feature and reset and save your new password in your browser, if you forgot the last one!)